How To Find Money Owed To You In Florida

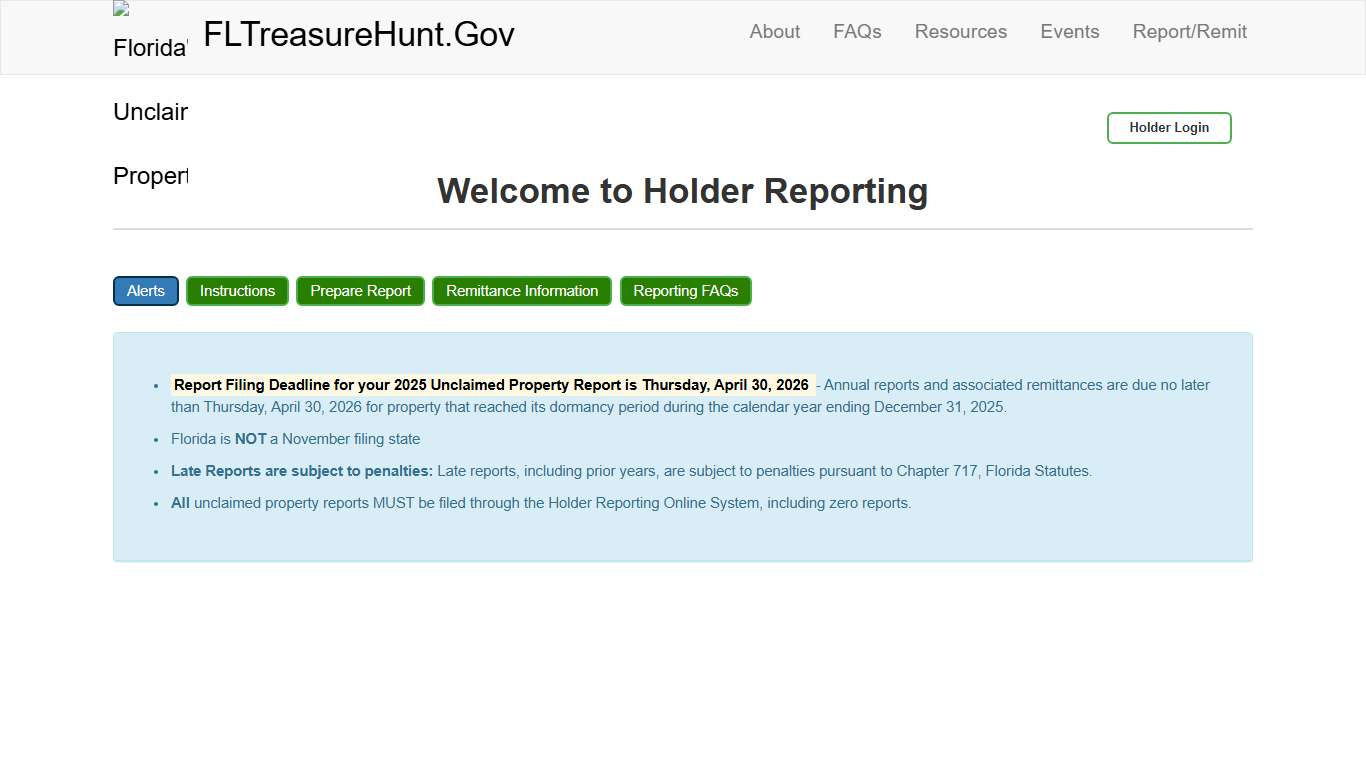

Report/Remit Unclaimed Property

Report Filing Deadline for your 2025 Unclaimed Property Report is Thursday, April 30, 2026 - Annual reports and associated remittances are due no later than Thursday, April 30, 2026 for property that reached its dormancy period during the calendar year ending December 31, 2025.

https://fltreasurehunt.gov/UP-Web/sitePages/ReportUnclaimedPropertyHR.jsf

National Association of Unclaimed Property Administrators (NAUPA) – The leading, trusted authority in unclaimed property

NAUPA is the leading, trusted authority in unclaimed property. We help individuals claim their unclaimed property, and help businesses ensure compliance per state law in annual reporting. Search for property in your state or province Use the interactive map below or select from the list to find the official unclaimed property program for a state or province.

https://unclaimed.org/

Search for your unclaimed property (it’s free) – National Association of Unclaimed Property Administrators (NAUPA)

Ready to find yours? Access your state's program here! There are several ways to find out if you have missing money, including visiting one of your state’s official unclaimed property outreach events. You can also find out immediately by using one of two key online search resources.

https://unclaimed.org/search/

Unclaimed Property Orange County Comptroller, FL

Unclaimed Property Every state in the United States of America has an unclaimed property law. Government agencies and other organizations are required to send unclaimed property to the state of a property owner's last known residence. That state will hold the property until the rightful owner is located.

https://www.occompt.com/276/Unclaimed-Property

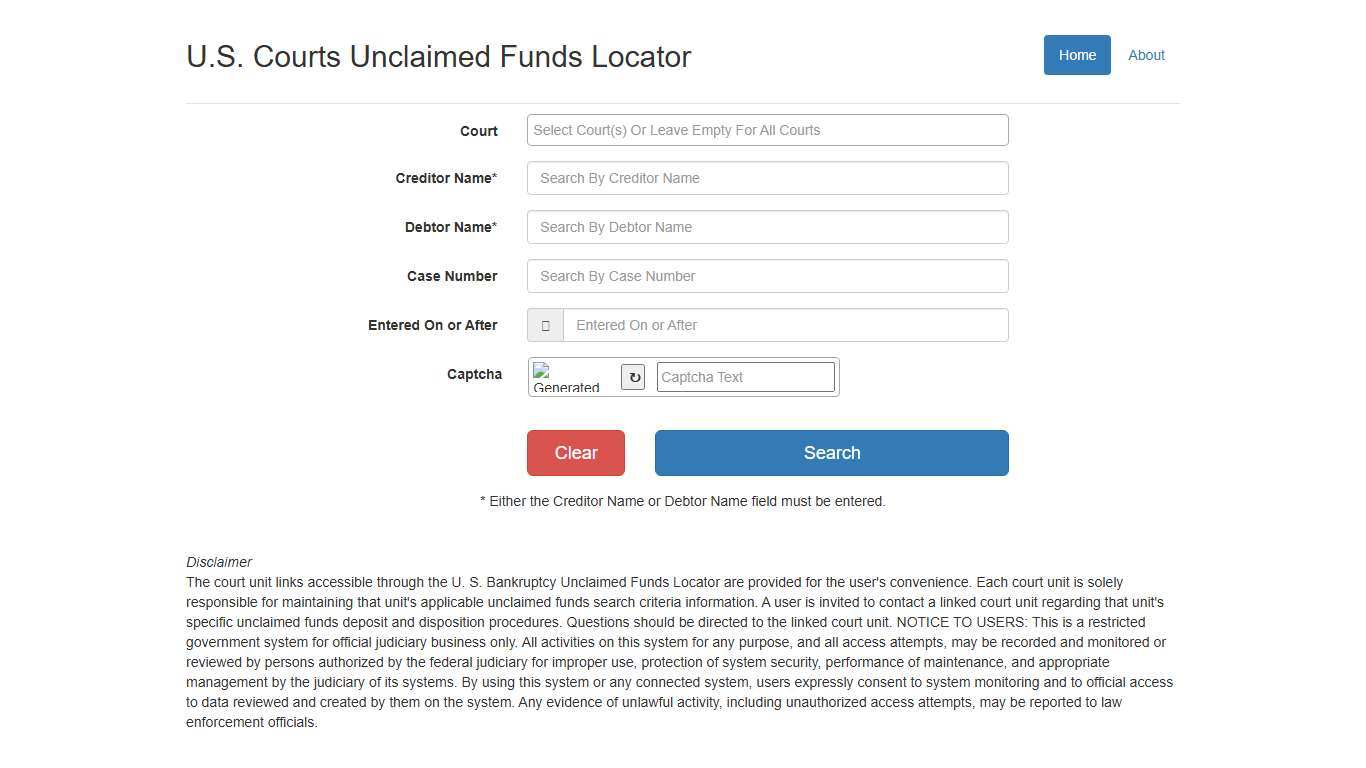

Unclaimed Funds Locator

* Either the Creditor Name or Debtor Name field must be entered.

https://ucf.uscourts.gov/

Unclaimed Funds Marion County Clerk of Court and Comptroller

Unclaimed Funds Per Chapters 197 and 717 of the Florida Statutes, excess monies are to be held by the Clerk for one year, then if not yet claimed, sent to the State of Florida as unclaimed property. Per Chapters 197 and 717 of the Florida Statutes, excess monies are to be held by the Clerk for one year, then if not yet claimed, sent to the State of Florida as...

https://www.marioncountyclerk.org/departments/records-recording/tax-deeds-and-lands-available-for-taxes/unclaimed-funds/

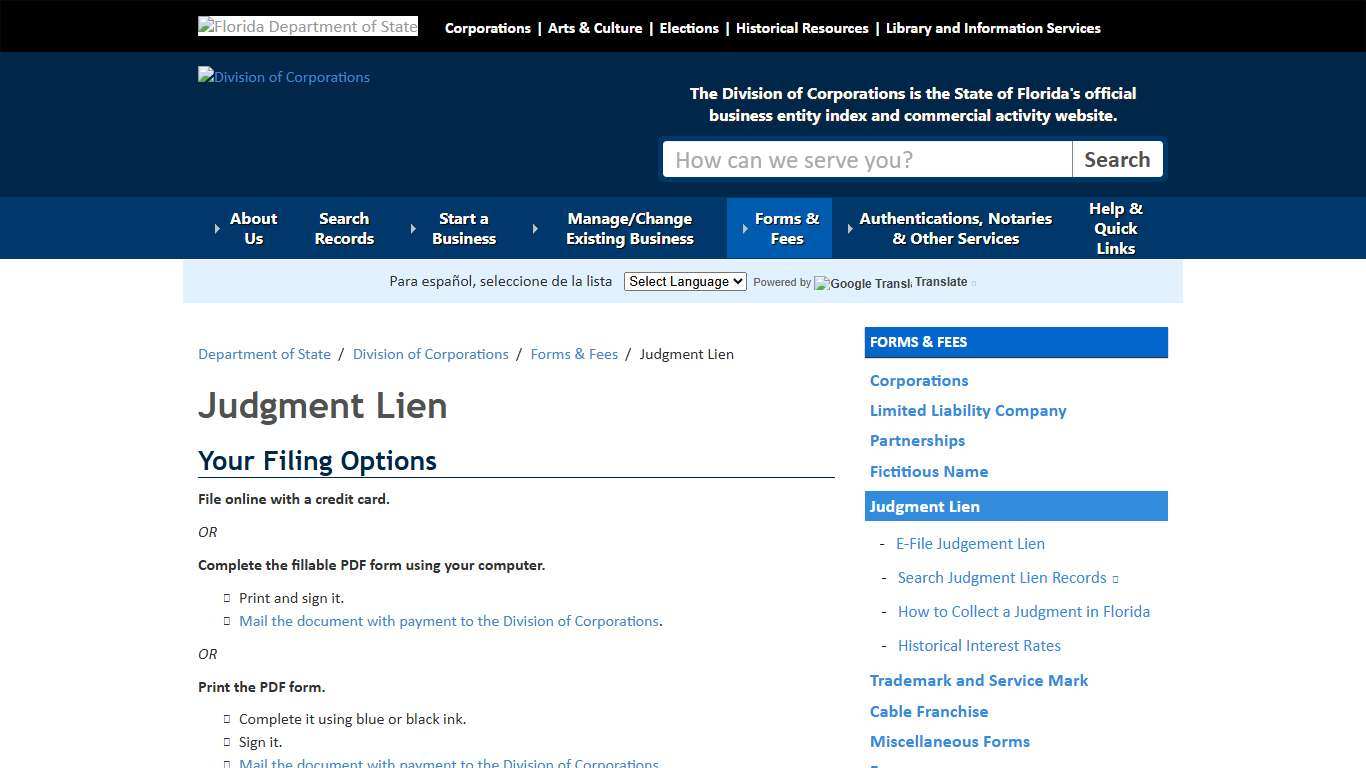

Judgment Lien - Division of Corporations - Florida Department of State

Judgment Lien Your Filing Options File online with a credit card. OR Complete the fillable PDF form using your computer. - Print and sign it. - Mail the document with payment to the Division of Corporations. OR Print the PDF form.

https://dos.fl.gov/sunbiz/forms/judgment-lien/

Search Beyond Your State – National Association of Unclaimed Property Administrators (NAUPA)

Search multiple states at once with MissingMoney.com Most states participate in MissingMoney.com—a free website, sponsored by NAUPA, from which you can search participating state’s databases for unclaimed property. MissingMoney.com will display any states in which there is a match, and provide information and links to the official government websites for beginning the claims process.

https://unclaimed.org/search-beyond-your-state/

Press Releases

- 1/22/2026 HIALEAH, Fla.- Today, Chief Financial Officer (CFO) Blaise Ingoglia awarded over $1.5 million to Florida fire departments. These funds will assist fire departments in purchasing new equipment to protect from cancer causing contaminants and improving emergency response capabilities. - 1/21/2026 Fernandina Beach, Fla.- Today, Chief Financial Officer (CFO) Blaise Ingoglia announced that Nassau County is excessively spending more than ...

https://myfloridacfo.com/news/pressreleases

Tax Deed Sales Orange County Comptroller, FL

Tax Deed Sales Each year, real estate taxes are to be paid by a predetermined date to avoid becoming delinquent. Once delinquent, the Tax Collector holds an auction in order to pay off the taxes. This auction is referred to as a Tax Certificate Sale (FS 197.432).

https://www.occompt.com/191/Tax-Deed-Sales

Tax Deed Sales Orange County Comptroller, FL

Tax Deed Sales Each year, real estate taxes are to be paid by a predetermined date to avoid becoming delinquent. Once delinquent, the Tax Collector holds an auction in order to pay off the taxes. This auction is referred to as a Tax Certificate Sale (FS 197.432).

https://www.occompt.com/191/Tax-Deed-Sales

Homeowner Assistance Fund U.S. Department of the Treasury

The Homeowner Assistance Fund (HAF) authorized by the American Rescue Plan Act, provides $9.961 billion to support homeowners facing financial hardship associated with COVID-19. HAF funds were distributed to states, U.S. Territories, and Indian Tribes. Funds from HAF may be used for assistance with mortgage payments, homeowner’s insurance, utility payments, and other specified purposes.

https://home.treasury.gov/policy-issues/coronavirus/assistance-for-state-local-and-tribal-governments/homeowner-assistance-fund

How to Collect a Judgment in Florida - Division of Corporations - Florida Department of State

How to Collect a Judgment in Florida Judgment Liens Definitions - Judgment Debtor: The losing party (the party that is ordered to pay a monetary amount by the court). - Judgment Creditor: The winning party (the party that is awarded a monetary amount by the court).

https://dos.fl.gov/sunbiz/forms/judgment-lien/collect-judgment/

What is unclaimed property? – National Association of Unclaimed Property Administrators (NAUPA)

The U.S. has billions of dollars in unclaimed property Do you have unclaimed cash or property waiting for you? Approximately 1 in 7 people do! There are literally billions of dollars in unclaimed property, held by state governments and treasuries within the United States.

https://unclaimed.org/what-is-unclaimed-property/

Property Taxes in Pinellas County - Pinellas County Tax Collector

The property tax year runs from January 1 to December 31 each year It is the responsibility of each taxpayer to ensure that taxes are paid, regardless of whether a tax notice is received or not. - If you do not receive a tax bill in November, contact our office at 727-464-7777 or search our online database for your bill.

https://pinellastaxcollector.gov/property-tax/property-taxes-in-pinellas-county/

Home — TreasuryDirect

Today’s Rates Processing Times Heavy volume is slowing our response time to requests sent by mail. The following transactions require at least six weeks of processing time if bonds and/or TreasuryDirect accounts are in your name. - Cashing paper savings bonds where you are named on the bonds, and you send in the bonds with your request - Unlocking your TreasuryDirect account or updating your banking information within that account...

https://www.treasurydirect.gov/

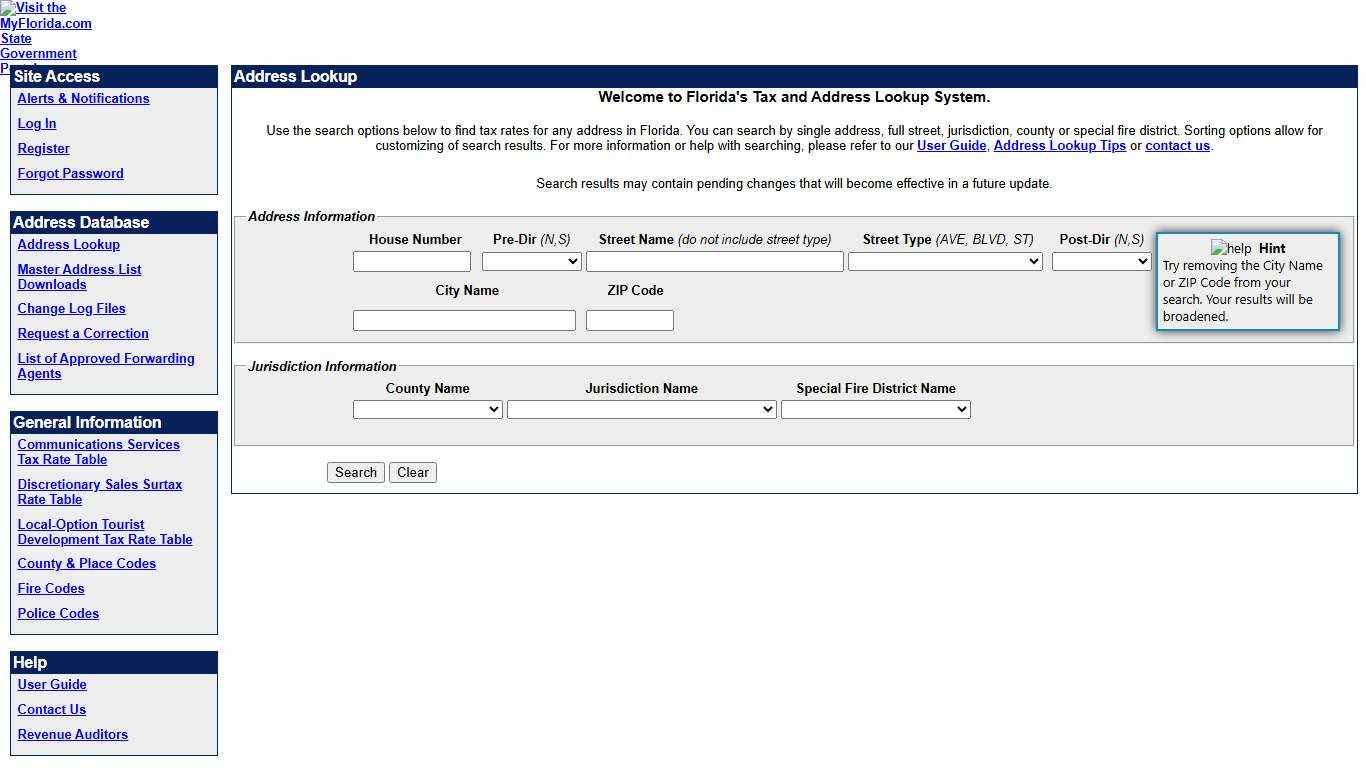

Address Search

Hint Try removing the City Name or ZIP Code from your search. Your results will be broadened.

https://floridarevenue.com/taxes/pointmatch

Jacksonville.gov - Property Appraiser

Joyce Morgan Duval County Property Appraiser Welcome! Welcome to the Duval County Property Appraiser’s website. Our staff is dedicated to providing you, the public, with the information you need to understand our role in determining your property values. We are here to assist you with commercial, residential, tangible personal property and exemption questions.

https://www.jacksonville.gov/departments/property-appraiser